Don’t make decisions on perception

What I’m reading

• [Early Retirement] was not what I expected. Honestly, I have never loved the acronym FIRE (in my head it should be FIER, which is the French word for pride) but I don’t begrudge people using it. They know what it means to them. I prefer FI just because in the early 90s when I read Your Money or Your Life that is the term they used – and it is via FI that allowed me to stay home with my kids, start a business, go back to work etc.. But I absolutely LOATHE when bloggers nitpick about people saying they’ve achieved FIRE but they still work. It’s like when people say “dividend investing isn’t a thing.” Of course it is, people have defined their terms and so the clarity is there. Being pedantic about it is just weird.

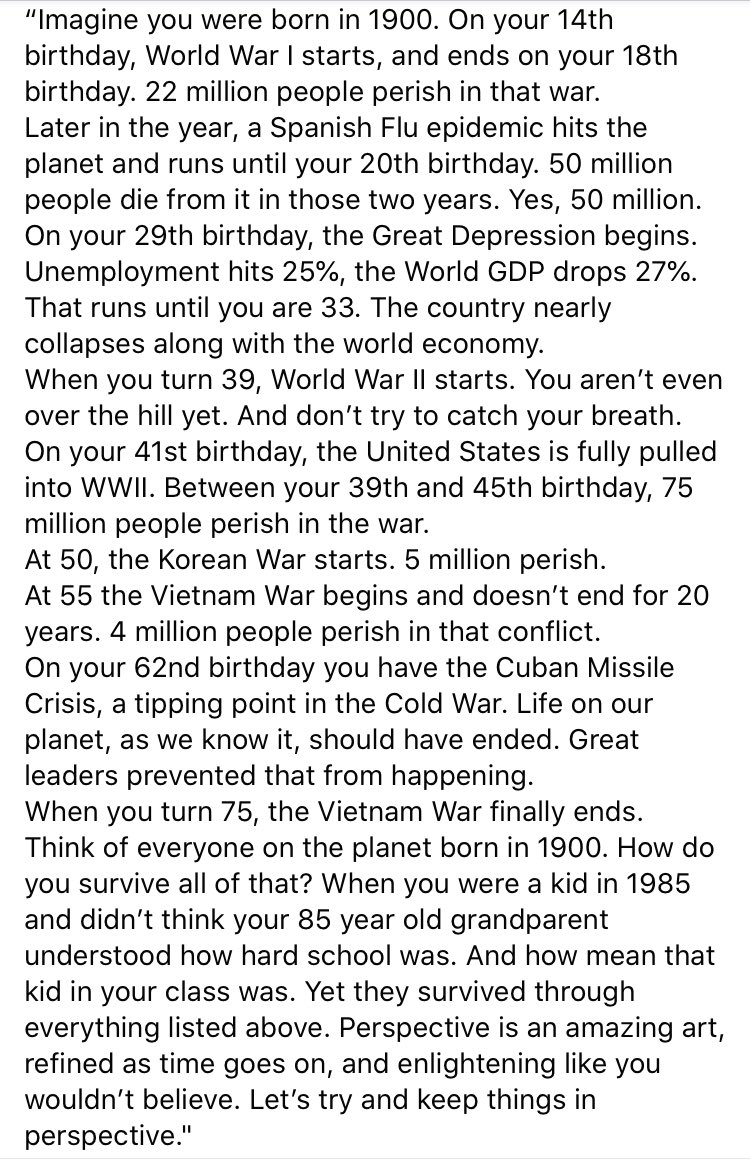

• Yes, and… this reminds me of a meme I stole from the internet:

A lot of the “this is the worst of times” suffers from the knowledge of history. Being in the middle of WWII when things were absolutely dicey (most people don’t realize how close it was at one point) was horrific. But from our place in 2023 where the Allies won, it doesn’t seem so scary. Sure, things definitely feel pretty terrible right now but how much of it is real and how much of it is just perception? We spend so much time on our phones and as a result of that the algorithm feeds us things that confirm our perspectives because that content keeps our eyeballs on their ads. It makes us more fearful and makes us believe things are so much worse than they are. It reminds me of this Dara O’Briain bit from 2009:

The Economist published this fascinating chart recently about how the pandemic has broken people’s views on the economy. The economy in the US is actually doing well, but people don’t believe that it is. It’s the first time since they started tracking sentiment that there has been such a wide gap. I suspect a lot of that is due to how we are constantly being fed doom and gloom from various social media sites. They call it doomscrolling for a reason.

But even if you go back and read economic headlines from the past, the only way we really knew things were good or bad was in retrospect. 2010-2020 was unprecedented for growth but for a lot of that period there was a lot of doom and gloom predictions floating around. This is a very good reason to ignore the noise and just focus on your goals. If you had believed a lot of the advice from “experts” you would have made some terrible decisions. Just leaving your money in an index fund for the entirety of that decade would have made you a very rich person. Ignore, ignore, ignore. Trust the process. Stay the course.